This article presents key insights from our latest market research into small business lending dynamics, particularly focusing on the lending process and the hurdles encountered in banks’ credit risk evaluations.

Small Business Lending Overview

Even after lending decisions are finalized, there’s often a gap in the systems necessary to document, monitor, and report on portfolio performance.

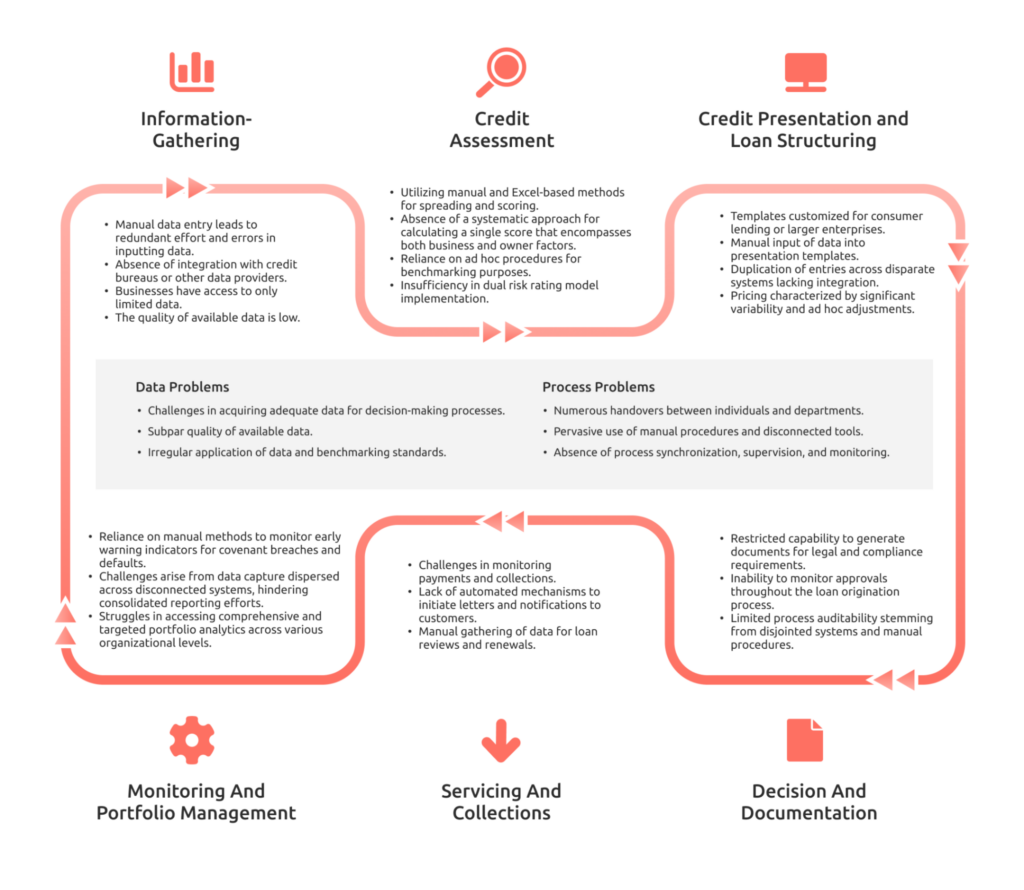

Banks may encounter challenges at every stage of the lending cycle, from information gathering to monitoring and portfolio management. These challenges are outlined in Figure 3.

Small businesses also encounter a unique set of challenges that hinder their access to credit, including:

- Limited knowledge about their credit risk and how to improve their business credit standing.

- Lack of transparency in banks’ credit assessment processes and expectations.

- Inconsistent requirements among banks regarding the lending process, necessary data, and documentation.

- Difficulty in maintaining up-to-date and accurate financial reporting due to manual processes and lack of expertise.

Figure 3 Pain Points Faced By Banks In The Small Business Lending Process

Emerging Trends in Small Business Lending

Amidst dwindling funding options and tepid support from traditional banks grappling with narrow margins in a low-interest-rate environment, small businesses are increasingly seeking easier access to loans. This gap in funding is being addressed by a surge of alternative lenders, though they face the hurdle of developing dependable credit assessment models and preparing for heightened regulatory oversight. In light of these dynamics, we have identified four key trends poised to drive substantial transformations in small business lending in the foreseeable future.

Supply of Funding

- Large and mid-sized commercial banks will continue to drive the majority of small business lending, and they will continue to require more information from small businesses to make lending decisions.

- Consolidation among smaller community banks will continue, contributing to a reduction in small business “relationship banking and an increase in standardized processes and rules for small business lending

- There will be greater opportunities for small businesses to raise funds through alternate avenues (eg, peer-to-peer firms, and insurance and asset managers) and capital markets (eg, Euronext platform to Invest in small and medium-sized enterprises).

- As alternative lenders increase their credit volume, they are likely to be regulated more closely and require external models and tools to validate and improve their credit decision-making.

- Lender margin pressures will continue as competition increases.

Demand for Funding

- Demand for small business funding is likely to increase as economic growth consolidates in the US and Europe.

- Alternative lenders have expanded the population of the “bankable” beyond businesses and individuals with traditional scores. This trend is expected to continue as new data becomes available to evaluate credit risk.

- The cost of funding for small businesses is likely to decrease as competition for loans to this segment Intensifies.

- Increased focus by government programs (eg, the Small Business Administration) and small business-focused associations (eg, the Small Business Financial Exchange) has led to more opportunities for funding.

Regulation

- Regulations aim to facilitate the entrance of new players in the small business lending space, while simultaneously addressing the risk to businesses and the economy posed by non-traditional models

- IFRS 9 will force lenders to shift some focus from risk management and capital allocation activities to earlier in the origination/decision process, and BCBS 239 will shift some focus to data management.

- Stress testing regulations are a driver for financial institutions to build better models to quantify their risk more comprehensively.

Technology and Data

- Access to small business information will be critical. For micro businesses, transparency of the credit decision process and data requirements will be key.

- Lenders will continue to aggressively expand the use of alternative types of small business information (e.g., big data) to evaluate risk, with the alternative lenders leading this space.

- Fintech lenders have disrupted the small business lending process. Computerized lending decisions are leading to quicker loan decisions, less onerous security/guarantee requirements, and a dramatically enhanced customer experience.

- Banks will adopt some of the practices of alternative lenders-such as increased automation of processes and reduced relationship banking-to remain competitive and maintain margins. Many will Invest in fintech startups, contributing to a shake-out and consolidation of the highly competitive and

Addressing the Challenges

- Lending organizations have significant opportunities to enhance the small business lending process across the credit life cycle. Key areas for improvement include:

- Enhancing Information Collection: Simplify the process of gathering borrower information by rethinking the required data and adjusting the level of detail based on risk exposure. Explore new tools and data sources to facilitate data gathering.

- Utilizing Proven Rating Models: Employ established rating models for standard loans, leveraging rich datasets reflecting historical small business defaults to ensure accuracy and reliability.

- Streamlining Processes: Focus on reducing the time-to-money by automating manual processes and implementing rule-based decisions. Allocate resources towards higher-value activities by fast-tracking simpler loan applications.

- Upgrading Infrastructure: Invest in upgrading systems to eliminate duplicate tasks through integration and adoption of cost-effective solutions. Consider outsourcing or utilizing cloud platforms for streamlined operations and reduced maintenance overheads.

- Learning from Data: Extract actionable insights from data to understand key performance indicators and meet audit and reporting requirements. Ensure data accuracy and availability through well-defined processes and advanced software solutions.

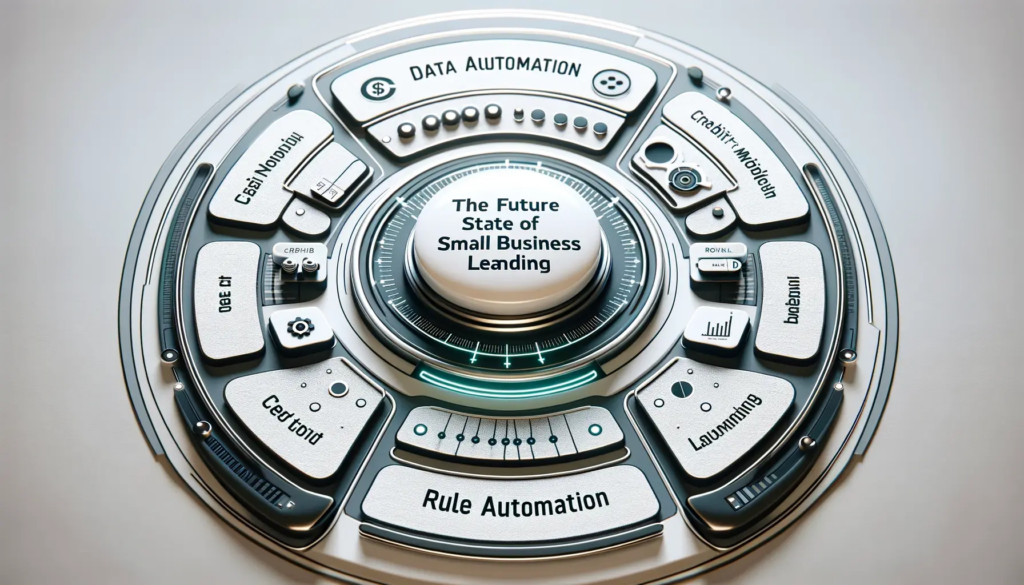

The Path Forward: The Future State of Small Business Lending

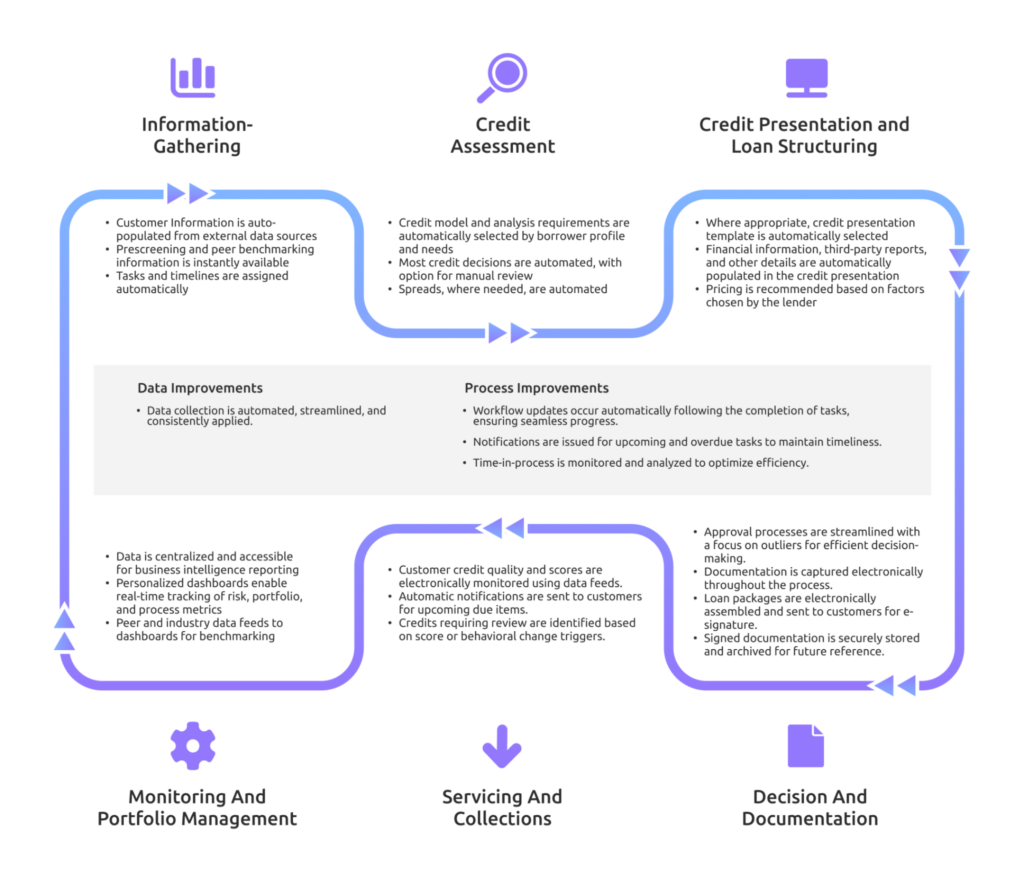

the future landscape of lending focusing on several key elements:

- Automation Tools for Data Gathering: Implementing tools to automate the collection and structuring of small business data from various sources such as financial statements and tax returns.

- Advanced Credit Modeling: Developing credit models that utilize a wider range of data beyond financial information, incorporating diverse factors to optimize lending decisions.

- Rule-Based Automation: Utilizing rule-based tools to automate processes and decisions, along with workflow functionality for effective tracking of tasks and requirements.

- Enhanced Monitoring and Intelligence: Enhancing capabilities for early warning, portfolio monitoring, and business intelligence to better manage risks and opportunities.

Figure 4 illustrates how these elements contribute to the future small business lending process.

To navigate the evolving market landscape, banks must embrace tools and technologies for improved data collection, process automation, automated scoring, and rule-based decision-making. This transformation also requires a re-evaluation of credit information solutions and the utilization of customer data to establish robust and validated credit decision frameworks.