This article presents key insights from our latest market research into small business lending dynamics, particularly focusing on the lending process and the hurdles encountered in banks’ credit risk evaluations.

Small Business Lending Overview

Financial institutions employ varying definitions for small and mid-sized business borrowers:

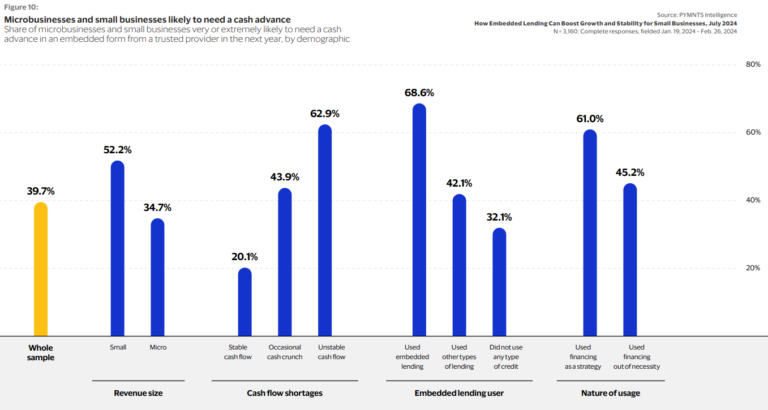

- Micro-enterprises typically generate less than $1 million in annual revenue and seek loans up to $250,000. They are often catered to through the branch network.

- Small businesses are characterized by revenue of around $20 million or less, or exposures under $1 million. They are typically served by the business banking sector.

- Middle-market enterprises usually have aggregate loan exposure ranging from $500 million to $20 million. They are commonly supported by the commercial or enterprise banking divisions.

For small business lending beyond branch banking, most bank lenders require three years of financial statements, obtained either through unaudited financial reports from the potential borrower or via business tax returns. These financials may be supplemented with bureau data on credit utilization and payment history.

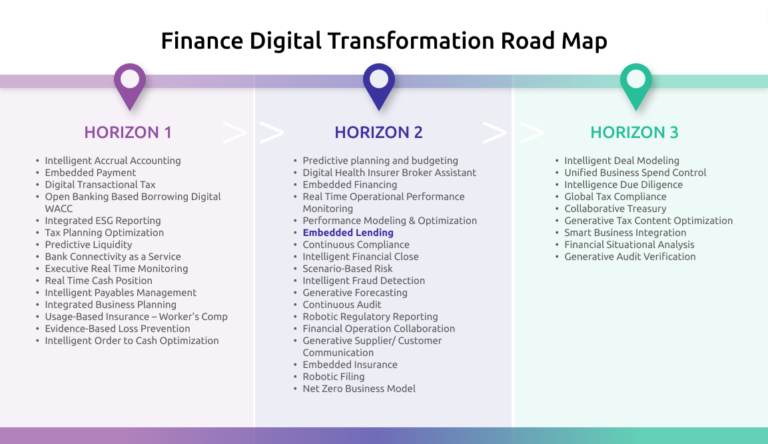

The data collected is typically fed into an internal scoring model containing attributes that evaluate the creditworthiness of both the business and its proprietors or guarantors. This information is manually inputted into bank systems to generate an internal risk rating, which may be compared against various external scores. Only a few banks have adopted auto-decisioning or indicated that they base small business loan decisions primarily on a quantitative model. Figure 2 illustrates this process.

Challenges in Small Business Lending

Despite small business loans comprising more than a quarter of the lending volume in the US, many banks lack effective systems and practices for accurately assessing small business risk and smoothly conducting lending activities. These challenges generally fall into two categories: data and process problems. Regarding data, the challenges include:

- Fragmented credit information vendor market, leading to a lack of a single source of credit information for financial providers and small businesses.

- Use of manual, time-consuming, and outdated processes by banks for collecting information from potential borrowers.

- Significant time spent by underwriters or credit managers in reconciling and consolidating data from various sources once it’s gathered.

- Frequent reliance on the credit risk of the small business owner or proprietor as a proxy for the business’s risk. Existing scoring models heavily reliant on consumer data lack credibility beyond micro-businesses and result in high levels of manual overrides.