In today’s dynamic financial landscape, small businesses are facing an unprecedented challenge: inflation. A recent survey conducted by a cloud-based accounting software platform sheds light on the profound impact of inflation on cash flow management for small business owners in Canada. With inflation rates persistently hovering above the preferred target range set by the Bank of Canada, many entrepreneurs are grappling with a unique set of difficulties. Inflation’s Ripple Effect on Cash Flow

The survey, which polled over a thousand Canadian small businesses, revealed that over half (53 percent) have experienced the repercussions of inflation on their cash flow management in the past six months. These challenges go beyond the financial realm, as respondents reported a noticeable increase in stress (54 percent) and trouble sleeping due to anxiety (35 percent).

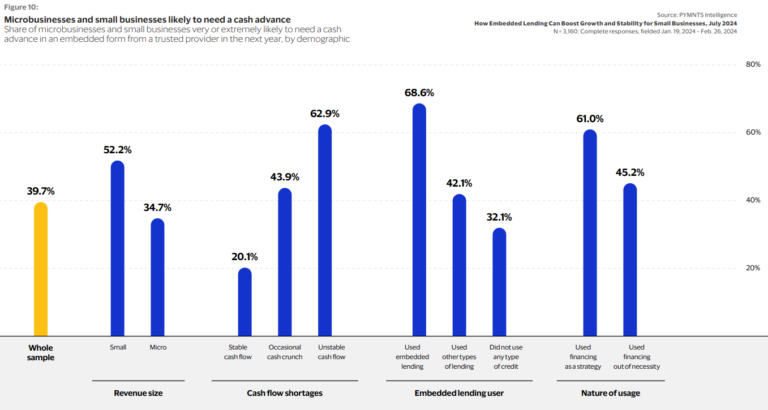

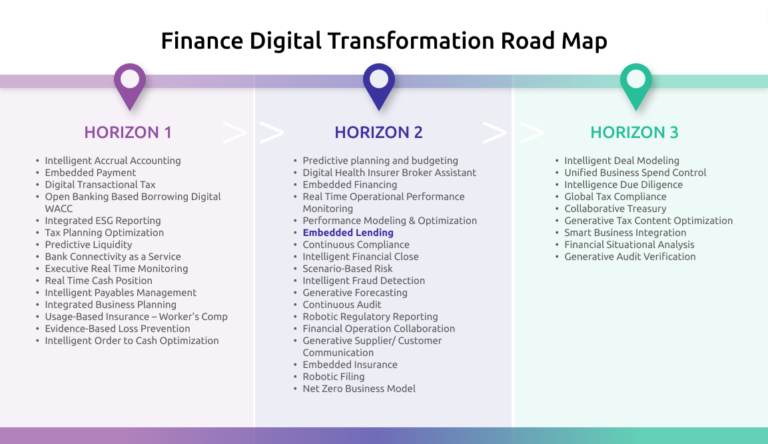

Embedded Lending: A Solution for Small Business Resilience

As inflation exerts pressure on cash flow, some small business owners have had to make difficult choices. For those in companies with no employees other than the owner, 31 percent admitted they were unable to pay themselves. Even in slightly larger businesses, those with two to nine employees, 33 percent faced a similar predicament. To weather the storm, 54 percent of businesses chose the path of raising prices.

Empowering Small Business Resilience

While the survey results highlight the challenges, they also underscore the resilience of small business owners. Business owners see an opportunity to enhance their financial acumen and alleviate the day-to-day stress of running a company. This mission, founded seventeen years ago in New Zealand, revolves around offering financial efficiency to clients.

Time-Saving Insights and Tools

Running a small business is a demanding task, leaving owners with limited time for financial management. One contributing factor is the overwhelming array of choices for digital tools, including accounting software. While only a third of small business owners stated that they primarily use accounting software to manage cash flow, many feel hesitant about making the right choice among numerous options.

A Vision for the Future

The aim is to simplify the lives of small business owners by providing them with time-saving solutions. One of these solutions is Analytics Plus, a predictive model that offers short-term cash flow forecasting and enables businesses to look ahead. By focusing on providing insights and tools that make financial management more efficient, the goal is to empower small business owners and help them regain some of their precious time.

Unlocking the Potential of Digital Payments

Interestingly, the survey revealed that only one in three Canadian small businesses actively uses digital and online payment gateways, representing a significant untapped opportunity for improving cash flow efficiency. By working with financial ecosystem partners VoPay, businesses can expedite payments and get paid faster.

A Promising Future Ahead

The commitment to enhancing small business owners’ financial efficiency and reducing their stress levels is poised to make a meaningful impact. As the financial landscape continues to evolve, the vision for the future involves leveraging technology, including embedded lending, to help businesses better manage their cash flow. The goal is to provide small business owners with insights, tools, and time-saving solutions, ultimately freeing them from the shackles of financial complexity.

In a world where financial challenges can seem insurmountable, this platform stands as a partner for small businesses, offering hope, resilience, and the promise of a brighter, more efficient financial future.