Commissioned by: Visa

Conducted by: PYMNTS Intelligence

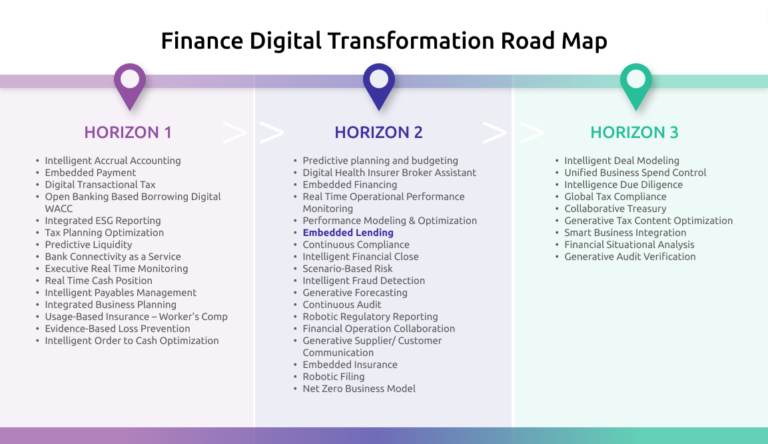

Introduction:

Embedded lending refers to credit tools integrated directly into a merchant or provider’s platform, allowing borrowers to apply for credit during transactions. This can include Buy Now, Pay Later (BNPL) services, cash advances, or instant loans. Embedded lending is a subset of embedded finance, and it is particularly beneficial for microbusinesses and small businesses, which often encounter cash flow challenges and limited access to traditional financing.

Key Findings:

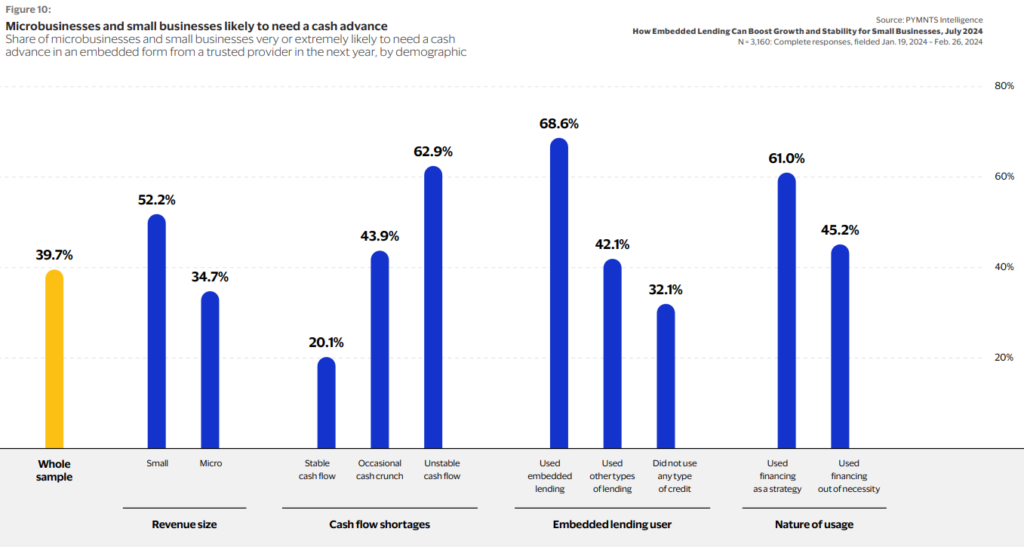

1. Unmet Demand for Lending Solutions:

Fewer than 1 in 5 businesses surveyed used embedded lending in the last year, with 14% of microbusinesses (revenue <$1M) and 26% of small businesses (revenue $1M-$10M) adopting it. This highlights a significant unmet need for accessible lending solutions.

2. Positive Experiences with Embedded Lending:

72% of businesses that used embedded lending reported high satisfaction with their available credit tools, compared to 57% for those using other types of lending and 42% for those who did not use credit at all. This satisfaction gap underscores the potential for increased adoption if awareness and access to embedded lending are expanded.

3. Cash Flow Stability and Credit Usage:

35% of businesses reported stable cash flows, while 44% experienced occasional cash crunches, and 22% had unstable cash flows. Those with unstable cash flows were 45% more likely to use credit for ongoing costs rather than growth, indicating a reliance on credit for survival rather than expansion.

Microbusinesses with unstable cash flows used credit primarily for operating costs (45%) compared to those with stable cash flows, who used it more for growth initiatives like renovations or expansions (75%).

4. Increased Borrowing with Embedded Lending:

Businesses that utilized embedded lending borrowed an average of $235,000, which is 48% more than those using other types of lending. Businesses investing in R&D and renovations borrowed even more, with averages of $287,000 and $264,000, respectively.

5. Preference for Speed and ERP Integration:

Speed is critical, with 63% of businesses with unstable cash flows likely to use embedded lending for cash advances if offered by a trusted provider, compared to 32% of those with stable cash flows.

41% of businesses indicated that integrating embedded lending with ERP systems is highly important. This integration was especially valued by those who had previously used embedded lending (68%) and those experiencing cash flow gaps (63%).

6. Willingness to Switch Providers:

69% of businesses that used embedded lending in the past year would switch providers to access it, compared to 38% of those using other types of lending and 29% of those who did not use credit.

Small businesses are more likely to switch providers to access embedded lending (49%) than microbusinesses (33%).

7. Comfort with Sharing Financial Data:

73% of businesses that used embedded lending were highly comfortable sharing real-time financial data, compared to 47% of those using other lending types and 37% of those not using credit.

Actionable Insights:

1. Targeting Unmet Demand:

There is a substantial opportunity for lenders to target the 56% of micro-businesses dissatisfied with current credit tools and the 69% of embedded lending users willing to switch providers for better options.

2. Focus on Cash Flow Challenges:

Lenders should prioritize businesses with unstable cash flows, as they are more likely to need quick, flexible financing solutions and are more open to switching providers.

3. Enhancing ERP Integration:

Providers should focus on integrating embedded lending with ERP systems to meet the needs of the 41% of businesses that consider this functionality crucial for managing cash flow.

4. Leveraging Familiarity:

Increasing awareness and familiarity with embedded lending can significantly boost adoption, particularly among businesses that have not yet used these tools but may benefit from them.

Conclusion:

Embedded lending offers a valuable solution for micro and small businesses, particularly those facing cash flow instability. By focusing on speed, integration, and targeted marketing, lenders and financial service providers can capture a significant market share and better serve these underserved segments.