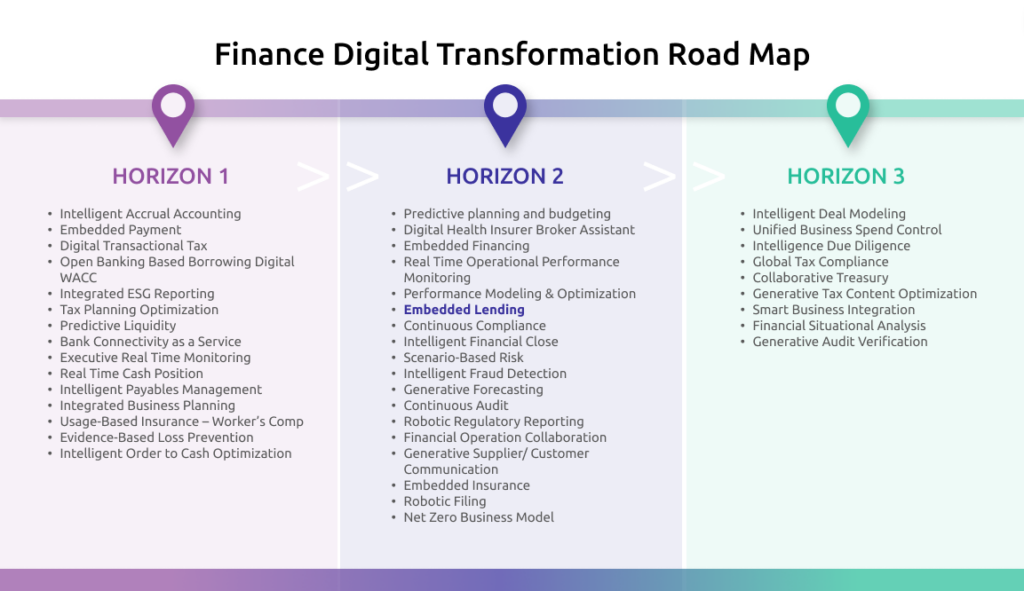

In today’s rapidly evolving financial landscape, the need for innovative and efficient solutions is more critical than ever. As outlined by IDC, the Finance Digital Transformation Roadmap presents a comprehensive strategy for modernizing financial operations through real-time insights, intelligent systems, and predictive analytics. At the forefront of this transformation is MegaHub, an embedded lending platform redefining access to working capital for Micro-Small-medium-sized businesses (MSMBs) worldwide.

The Vision of MegaHub

MegaHub was created with a clear vision: to provide seamless and efficient pathways for MSMBs to secure the Working Capital they need to thrive. Traditional lending processes can be cumbersome and time-consuming, often leaving businesses in financial limbo. MegaHub addresses these challenges by integrating directly with vertical software applications, simplifying the borrowing process, and providing timely financial support.

How MegaHub Aligns with the Finance Digital Transformation Roadmap

The Finance Digital Transformation Roadmap highlights several key areas that align perfectly with MegaHub’s capabilities and vision:

1. Real-Time Insights & Guidance

MegaHub provides real-time insights into the financial health and borrowing capacity of MSMBs. By leveraging data analytics and integration with business software, MegaHub ensures that businesses can make informed decisions quickly and efficiently.

2. Intelligent Treasury and Cash Management

MegaHub’s platform facilitates intelligent treasury management by connecting MSMBs with prime lenders and offering tailored loan options. This integration ensures optimal cash flow management and financial stability.

3. Digital Risk and Insurance

By embedding lending solutions within software applications, MegaHub mitigates financial risks for MSMBs. Our platform’s ability to offer pre-qualified loan options reduces the uncertainty and risk associated with traditional lending processes.

4. Predictive Planning and Budgeting

MegaHub’s use of predictive analytics aligns with the roadmap’s focus on predictive planning and budgeting. By analyzing financial data, MegaHub helps businesses anticipate their funding needs and plan accordingly.

5. Embedded Lending and Financing

The roadmap emphasizes the importance of embedded financing solutions, and MegaHub is a prime example of this innovation. Our platform integrates lending solutions directly into the software applications businesses use daily, making access to working capital seamless and efficient.

Why MegaHub Stands Out

- Geographical Flexibility: MegaHub is not limited by geographic boundaries. Our platform operates globally, ensuring businesses and lenders worldwide benefit from our services.

- Lender Autonomy: MegaHub provides lenders with access to our lending hub, allowing them to set up their processes and applications. We provide the necessary data while allowing complete autonomy in the underwriting process.

- Extensive Network: With access to a network of over 120,000 SMBs, MegaHub offers a broad and diverse customer base, ensuring that lenders can reach a wide audience.

The Future of Finance with MegaHub

As the Finance Digital Transformation Roadmap outlines, the future of finance is digital, integrated, and intelligent. MegaHub is leading the charge by providing innovative solutions that empower businesses and streamline financial processes. Our platform’s ability to integrate seamlessly with existing software applications and provide real-time financial insights makes us a critical player in the digital transformation of finance.

Conclusion

MegaHub is more than just a lending platform; it’s a comprehensive solution designed to empower SMBs by providing them with the financial tools they need to succeed. As we continue to grow and expand our services, we remain committed to making a positive impact on the SMB ecosystem and aligning with the strategic priorities outlined in the Finance Digital Transformation Roadmap.

Stay tuned for more insights and updates as we continue to explore and shape the future of embedded lending and digital finance.