So far, we’ve covered the Rise of Gig Workers and where they’re headed, How Software Apps Add Value and finally we’ve arrived at Why Platform-to-Platform is the Wave of the Future.

Many lenders face similar challenges when onboarding new clients:

-Finding appropriate clients

-Verifying identification and documentation

-Verifying income

-Streaming the loan process, among other hurdles

What is the solution to making the entire process easier? Platform-to-Platform.

Lenders Lean into Platform-to-Platform Solutions

By using the Platform-to-Platform Solution lenders are finding the entire process of onboarding a new client, verifying the loan and then releasing the funds much smoother.

The reason is that the user, say for example a Gig Worker, has all their information uploaded to a Service Platform. (A Service Platform is a platform that allows users with paid services to deliver goods, information, or a unique service. Transportation and food delivery is the most widespread use of Service Platforms).

All of the Gig Workers valuable information is uploaded to this Platform, such as income, identity and hours worked.

So, if a worker needs a loan, when a lender is on the Platform they will be able to see all applicable information and within minutes hit ACCEPT or DECLINE.

Other benefits? No extra paperwork that needs to be filled out, no banking information that needs to be uploaded or extra identification requirements. Everybody wins.

Perfect Opportunity for Platforms – Gig Workers Aren’t Happy

No doubt right now is the perfect time for digital platforms (and lenders who use them) to consider enhancing areas that need improvement. In fact, according to a Payments Canada study, Canadian Gig Workers are frustrated with how and when they get paid through online platforms and mobile apps despite 51% who depend on them for Gig Income. However, as Gig Economy engagement evolves, payment concerns point to new opportunities for digital platforms.

Currently, more than 1 in 10 Canadians work in the Gig Economy, and over 20% of them rely on Gig Work as their primary source of income and 65% utilize it to supplement their income. And this is expected to trend upwards.

With Gig Workers not totally thrilled about some of their current digital experiences, this is a great opportunity for everyone to expand current platforms, or consider using a new one.

MegaHub and Embedded Lending

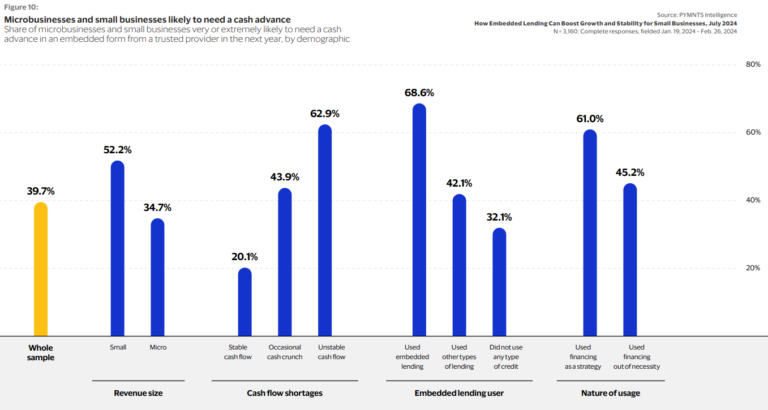

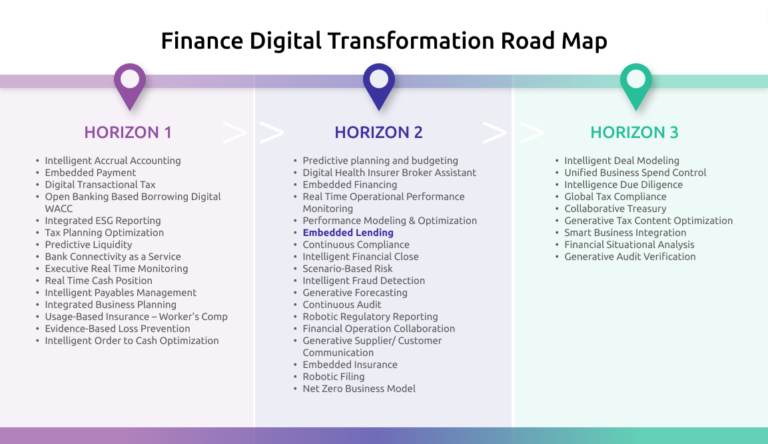

We hear Gig Workers and understand what is needed in this space. That’s why MegaHub is focused on Embedded Lending. We are a Lending as a Service platform allowing vertical software applications to offer embedded lending to their customers. Our solution is designed to cater to various platforms, serving the Gig Economy, property managers, and payroll software providers. Customers of these platforms, individuals or businesses, can access various loan products at their fingertips.

Embedded lending means the lending occurs through existing products or services, in our case existing software, which provides users quick access to money through their own existing financial universe. Typically, done outside of a “traditional” financial institution.

At MegaHub we include Embedded Lending in our software to arm the user with power, financial inclusion, and choice.

Platform-to-Platform – To Infinity and Beyond

Once lenders and Gig Workers harness the power of Platform-to-Platform, we at MegaHub believe there will be no turning back. With the inbuilt power of Embedded Lending, the process will be too smooth, too quick and too readily available to ever go back.