Gig Workers are playing an increasingly essential role in global economies. And its no longer only Uber Drivers that come to mind when the image of a Gig Worker pops up.

It’s highly skilled contractors, AirBnb landlords, artists and freelancers. It’s professionals that are looking to earn extra income on the side in a world facing high inflation. In fact, 55% of gig workers also maintain full-time or regular jobs, according to PYMNTS.

Moreover, 36% of U.S. workers participate in the Gig Economy through either their primary or secondary jobs.

So, what does this mean? Gig Workers aren’t going anywhere fast (see chart), and their expectations are increasing, especially when it comes to payments.

By 2027: More than half the U.S. workforce will be gig workers. (Source: Forbes.)

MegaHub – The Future has Arrived

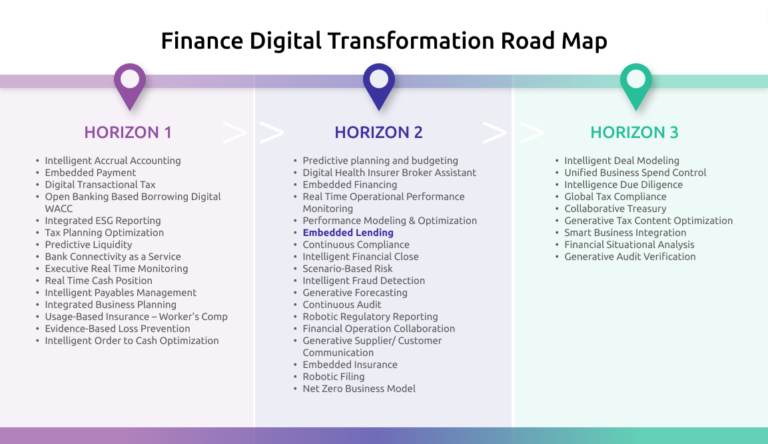

What is Megahub? A Lending as a Service platform allowing vertical software applications to offer embedded lending to their customers. Our solution is designed to cater to various platforms serving the gig economy, property managers, and payroll software providers.

Customers of these platforms, individuals or businesses, can access various loan products at their fingertips.

How does MegaHub help Gig Workers? For gig economy platforms, MegaHub enhances its offering by providing embedded lending solutions, allowing workers to access funds quickly and conveniently.

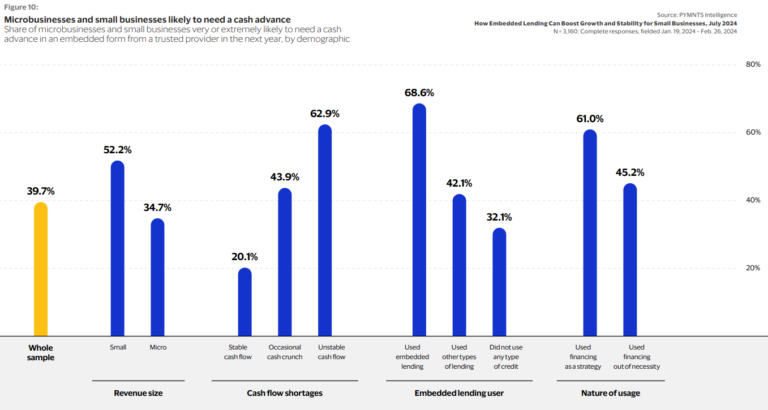

Embedded Lending

MegaHub offers embedded lending, meaning the borrowers (applicants) can apply within the service platform. For example, if an Uber Driver wants to apply for a loan, the driver will see a section within the Uber app that says: Apply for a loan. And they can apply from within. From there, MegaHub receives the information and we then pass that to our lenders, where they can accept or decline.

MegaHub essentially acts as a facilitator. With MegaHub’s lending hub, customers of these platforms, whether individuals or

Challenges Facing Gig Workers

We understand how tough it is to get a loan as a Gig Worker. Globally, the lack of support from financial institutions is a critical issue. According to The Banker:

It is difficult for Gig Workers to access capital because their income isn’t recurring, necessarily. And traditional financial institutions are sticky when it comes to lending to someone without a salary; combined with income being difficult to verify.

We believe in Gig Workers. And we believe in a fair – open – financial landscape.

Together, we are reshaping the landscape, fostering financial inclusion, and empowering both borrowers and lenders to achieve their financial aspirations.

We are doing this by empowering platforms to offer embedded lending.

For gig economy platforms that means providing embedded lending solutions, granting workers swift and convenient access to funds. Which creates a seamless ecosystem; but most importantly offers Gig Workers a space to take control of their own journey.