One word: EMBEDDED. Embedded loans are the way of the future. No more waiting on income and identify verification. No more banking and transferring money, and then waiting, between apps and financial institutions. The future is integration, and it has arrived.

Wait – No more bank lineups, or waiting on hold for 60 minutes to speak to someone, but how?

Let’s look at the three ‘Embedded terms’ to explain their power:

What is Embedded Finance?

of financial services like lending, payment processing or insurance into nonfinancial businesses’ infrastructures without the need to redirect to traditional financial institutions.

Some examples are: Microloans, BNPL (buy now pay later) and Apple Pay. You’re likely already using embedded finance in some form.

What is Embedded Lending?

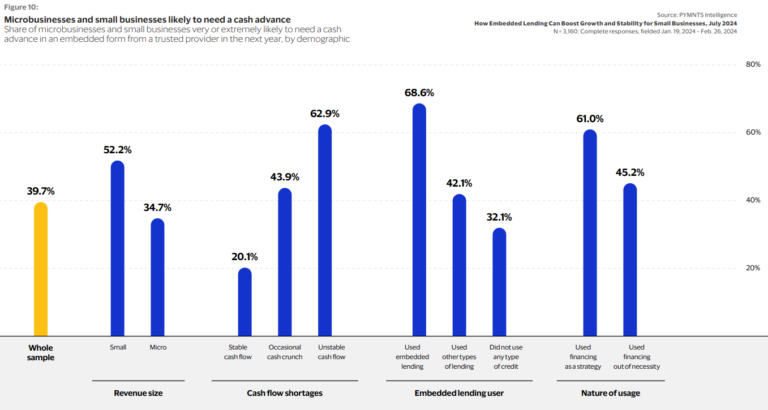

Embedded lending means the lending occurs through existing products or services, in our case existing software, which provides users quick access to money through their own existing financial universe. Typically, done outside of a “traditional” financial institution.

At MegaHub we include Embedded Lending in our software to arm the user with power, financial inclusion, and choice.

And What About an Embedded Loan?

The Embedded loan is the result of the lending and is usually deposited via app or the preferred method of the user.

Software Apps Add Value

Software apps now include many of the three Embedded topics that we just reviewed. Let’s see how they add value to the user:

Manage Everything in One Place: Things like payroll management or any type of health benefits, plus loans. Which also allows the worker to better manage their finances, overall.

Saves Time: Gig Workers have access to all payment management and finances in one spot – no more toggling between multiple apps.

Strengthened Engagement: If the payment provider (business owner) is also on the app.

Income and Identify Verification: Already complete. No extra paperwork or hassle, the software knows who you are and what you earn, and exactly why you’re a good candidate for a loan or any other payment need that comes up.

Specifically, with MegaHub, it allows the worker to have access to potential loans, by acting as the facilitator.

Sorry – Once More – What is MegaHub?

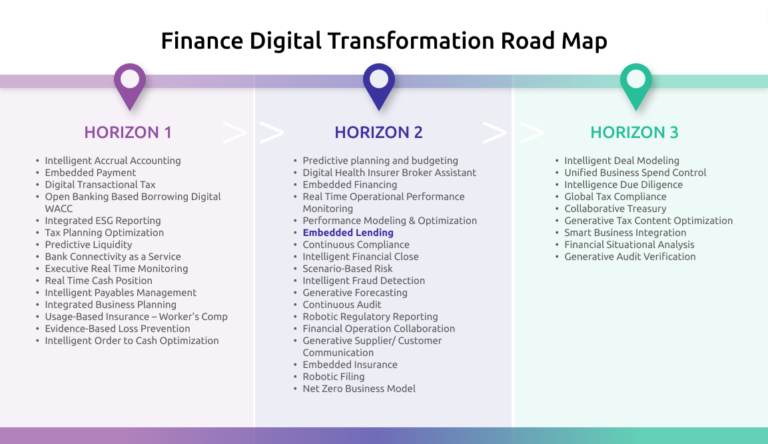

An innovative Lending as a Service platform that seamlessly integrates embedded lending into vertical software applications, catering to a diverse range of industries, from gig economy platforms to property managers and payroll software providers.

For gig economy platforms, MegaHub revolutionizes their services with embedded lending solutions, providing workers quick and convenient access to funds, for gig workers. In the PropTech industry, we enable property management platforms to offer financing options to tenants, elevating customer satisfaction. Similarly, supply chain software providers can leverage MegaHub to facilitate seamless financing for businesses involved in logistics and procurement.

At MegaHub we are laser focused on embedded lending, so that vertical software applications can offer embedded lending services. This simplifies the process for the user and offers them products and services that are available within their ecosystem. No toggling, no extra steps – everything available at your fingertips.